Macrs Life For Solar Panels

Macrs depreciation is an economic tool for businesses to recover certain capital costs over the solar energy equipment s lifetime.

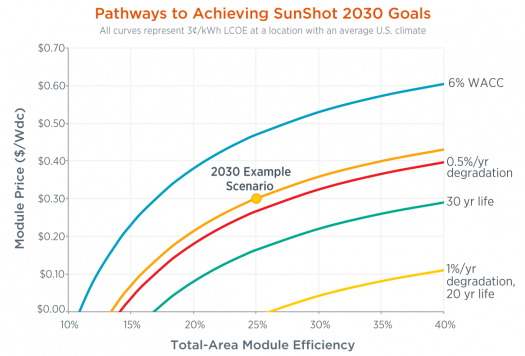

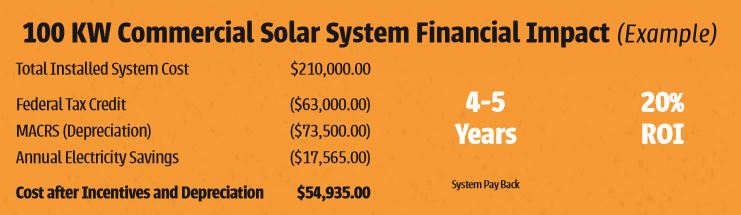

Macrs life for solar panels. Solar energy systems are depreciable property just like land or buildings. Allowing businesses to deduct the appreciable basis over five years reduces tax liability and accelerates the rate of return on your solar investment. Using macrs depreciation for solar energy projects. With this being said installing a qualifying solar system can allow businesses to use the macrs depreciation method to be classified as a green energy property and obtain tax benefits.

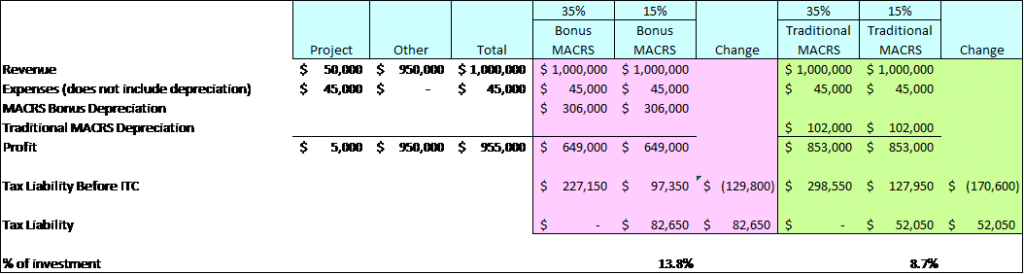

As long as you install this system in 2020 you ll be able to take advantage of the federal solar incentive tax credit at 26. Macrs depreciation of solar panels. Quick facts about macrs. In this case solar energy systems have been determined by the irs to have a useful life of five years.

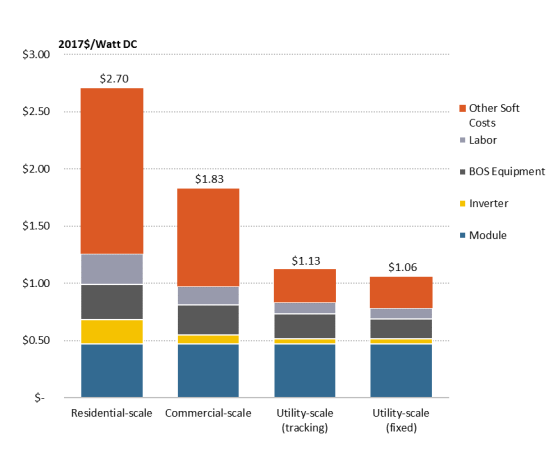

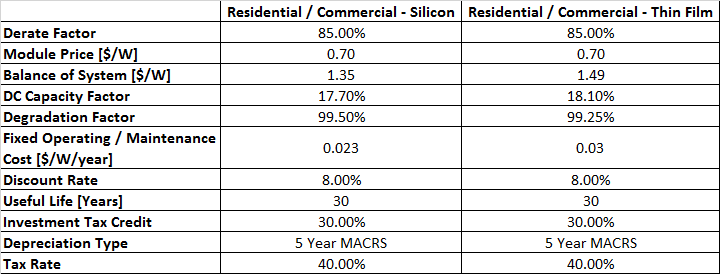

Normally the depreciable life of solar panels is 85 of the full solar system cost which may be depreciated roughly as follows. Macrs solar accelerated depreciation what is the macrs depreciation benefits of solar panels. Macrs pronounced makers stands for modified accelerated cost recovery system and depreciation is known as the reduction in the value of an asset over time due to wear and tear or normal use. Depreciation is classified as an expense and may be deducted from your taxable income thus reducing the cost incurred for the solar power system.

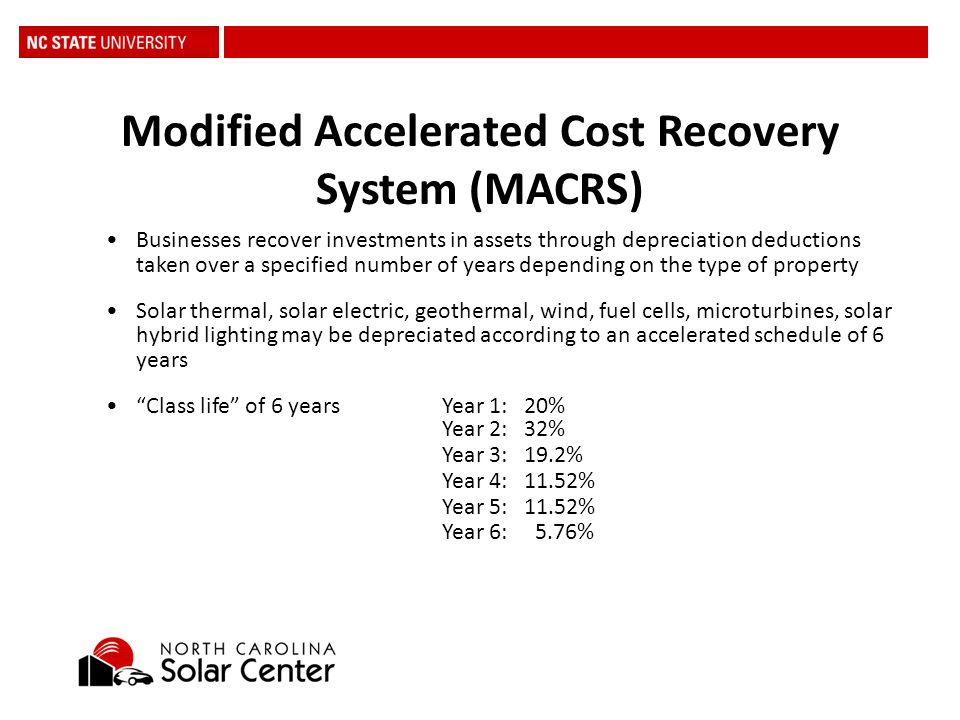

The modified accelerated cost recovery system macrs established in 1986 is a method of depreciation in which a business investments in certain tangible property are recovered for tax purposes over a specified time period through annual deductions. Qualifying solar energy equipment is eligible for a cost recovery period of five years. Let s figure out the macrs depreciation for a solar system that costs 300 000 before incentives. But since we have to calculate depreciation with half of the tax credit.

Year 1 20 year 2 32 year 3 19 2 year 4 11 5 year 5 11 5 and year 6 5 8. Even though solar arrays will last for decades the irs expects that a business will apportion the entire value of the array over five years in their taxes. Qualifying solar energy equipment is eligible for a cost recovery period of five years.

.jpg)